About Estate Planning Attorney

About Estate Planning Attorney

Blog Article

Some Known Details About Estate Planning Attorney

Table of ContentsThe 9-Minute Rule for Estate Planning AttorneySome Of Estate Planning AttorneyThings about Estate Planning AttorneyHow Estate Planning Attorney can Save You Time, Stress, and Money.An Unbiased View of Estate Planning AttorneyGetting The Estate Planning Attorney To WorkThe Ultimate Guide To Estate Planning Attorney

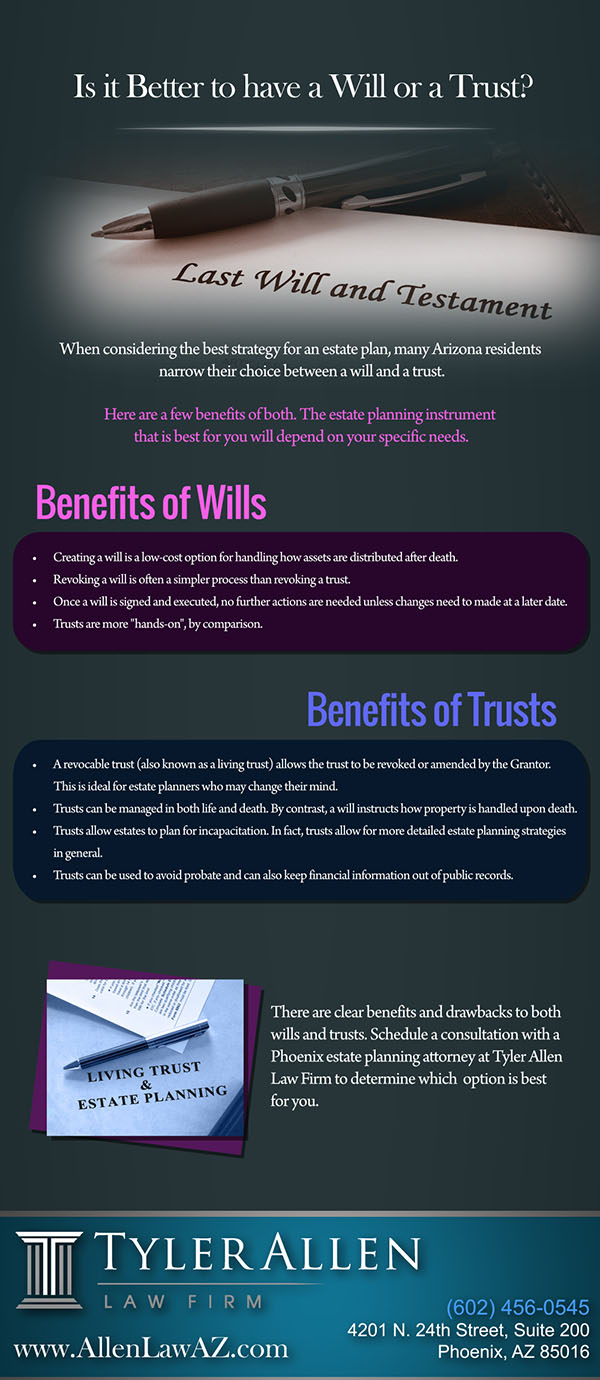

That you can avoid Massachusetts probate and shelter your estate from estate tax obligations whenever feasible. At Center for Elder Law & Estate Preparation, we recognize that it can be challenging to believe and talk about what will certainly occur after you pass away.We can help. Call and establish a cost-free assessment. You can additionally reach us online. Serving the higher Boston and eastern Massachusetts areas for over three decades.

They help you create a comprehensive estate plan that lines up with your wishes and goals. Estate intending lawyers can aid you stay clear of blunders that might invalidate your estate plan or lead to unplanned repercussions.

Estate Planning Attorney for Dummies

Working with an estate preparation lawyer can aid you prevent probate completely, saving time, and money. An estate preparation lawyer can help secure your assets from legal actions, financial institutions, and various other claims.

To find out concerning actual estate,. To learn regarding wills and estate planning,.

The age of majority in a given state is established by state regulations; usually, the age is 18 or 21. Some properties can be dispersed by the organization, such as a bank or brokerage firm, that holds them, as long as the proprietor has offered the proper instructions to the banks and has actually named the beneficiaries who will receive those assets.

Some Known Questions About Estate Planning Attorney.

If a recipient is named in a transfer on death (TOD) account at a broker agent company, or payable on death (SHELL) account at a financial institution or credit scores union, the account can normally pass straight to the recipient without going through probate, and therefore bypass a will. In some states, a comparable beneficiary designation can be contributed to actual estate, enabling that asset to also bypass the probate process.

When it involves estate planning, a seasoned estate lawyer can be an indispensable property. Estate Planning Attorney. Collaborating with an estate planning lawyer can offer countless benefits that are not available when attempting to complete the procedure alone. From offering expertise in legal matters to assisting produce a detailed prepare for your family's future, there are lots of advantages of dealing with an estate preparation lawyer

Estate lawyers have considerable experience in recognizing the subtleties of numerous legal papers such as wills, depends on, and tax obligation legislations which enable them to offer sound suggestions on how best to protect your properties and guarantee they are passed down according to your desires. An estate lawyer will likewise have the ability to give suggestions on just how ideal to browse intricate estate regulations in order to make certain that your desires are recognized and your estate is taken care of effectively.

About Estate Planning Attorney

They can commonly supply advice on just how best to upgrade or produce new papers when needed. This might include recommending adjustments in order to make use of brand-new tax advantages, or merely making sure that all relevant records show one of the most current recipients. These attorneys can likewise provide continuous updates connected to the that site administration of counts on and various other estate-related matters.

The objective is constantly to guarantee that all documents remains legitimately accurate and shows your existing wishes precisely. A major advantage of dealing with an estate planning lawyer is the important support they give when it involves avoiding probate. Probate is the legal procedure throughout which a court identifies the credibility of a departed person's will and manages the circulation of their assets according to the terms of that will.

A seasoned estate attorney can help to guarantee that all needed records remain in area which any kind of assets are correctly distributed according to the regards to a will, avoiding probate altogether. Eventually, dealing with a skilled estate preparation lawyer is just one of the most effective ways to ensure your wishes for your family's future are performed as necessary.

They give like it important legal guidance to ensure that the most effective passions of any kind of small youngsters or grownups with specials needs are completely shielded (Estate Planning Attorney). In such instances, an estate lawyer will certainly assist identify suitable guardians or conservators and make certain that they are given the authority essential to take care of the possessions and affairs of their charges

Top Guidelines Of Estate Planning Attorney

Such counts on normally include provisions which secure benefits obtained with government programs while permitting trustees to maintain minimal control over how properties are handled in order to take full advantage of benefits for those included. Estate attorneys comprehend exactly how these counts on job and can offer invaluable assistance establishing them up correctly and making certain that they remain lawfully compliant gradually.

An estate planning lawyer can aid a parent include stipulations in their will for the treatment and monitoring of their small youngsters's assets. Lauren Dowley is a knowledgeable estate preparation attorney that can help you create a plan that fulfills your specific requirements. She will certainly collaborate with you to comprehend your properties and just how you want them to be distributed.

Do not wait to begin estate preparation! It's one of the most crucial things you can do for on your own and your liked ones.

The Estate Planning Attorney Statements

Producing or updating existing estate preparation papers, consisting of wills, counts on, health and wellness care instructions, powers of lawyer, and associated tools, is one of one of the most vital things you can do to ensure your dreams will be honored when you die, or if you end up being not able to handle your events. In today's digital age, there is no shortage of diy choices for estate planning.

Nonetheless, doing so can cause your estate plan not doing what you desire it to do. Working with an estate planning lawyer to prepare and assist implement your lawful documents is a smart choice for a range of reasons:. Wills, depends on, and other estate intending papers ought to not be something you prepare once and never revisit.

Probate and count on regulations are state-specific, and they do change from time-to-time. Functioning with a lawyer can provide you assurance recognizing that your plan fits within the specifications of state law. One of the largest pitfalls of taking a diy method to estate preparation is the threat that your files will not absolutely achieve your objectives.

Our Estate Planning Attorney PDFs

They will certainly take into consideration numerous circumstances with you to compose papers that precisely show your dreams. One usual false impression is that your will certainly or trust fund immediately covers all of your assets. The truth is that specific sorts of home ownership and recipient classifications on possessions, such as retired life accounts and life insurance policy, pass individually of your will certainly or count on unless you take steps to make them collaborate.

Report this page